Gamblers in Ontario wagered approximately $17.8 billion and the market produced $690 million in total gaming revenue — from iCasino, online sports betting, and online poker — from Jan. 1, 2024-March 31, 2024, according to iGaming Ontario’s 2023-24 Q4 market report released on Wednesday.

With the final quarterly numbers now revealed, we know that Ontarians wagered approximately $63 billion and the regulated market in the province produced $2.4 billion in total gaming revenue during the fiscal year (April 1, 2023-March 31, 2024), representing a 78% increase year-over-year in total wagers and a 72% YoY increase in total gaming revenue.

As of March 31, there were 47 operators offering 77 online gaming websites. Over 1.3 million player accounts were active during Q4 and monthly spend per active player account was $263 (note: iGO is now using an updated calculation method for this metric).

“With $63 billion in wagering and $2.4 billion in gaming revenue, the second year of Ontario’s igaming market is more than 70% bigger than the first,” said iGaming Ontario Executive Director Martha Otton in a press release. “As the market matures into its third year, I look forward to building on this foundation of success with operators and other partners as they invest in Ontario so that Ontarians can continue to play with confidence.”

Figures provided by iGO don’t include revenue generated by the Ontario Lottery Corporation (OLG) and its online gambling products. OLG was the only legal provider of Internet gaming before the launch of Ontario’s regulated iGaming market on April 4, 2022, and it still expects to maintain approximately 25%-30% of the online gaming market share despite increased competition from private operators, according to a recent Auditor General report.

Revenue breakdown

Here’s a breakdown of how Ontarians gambled online during the last quarter and fiscal year.

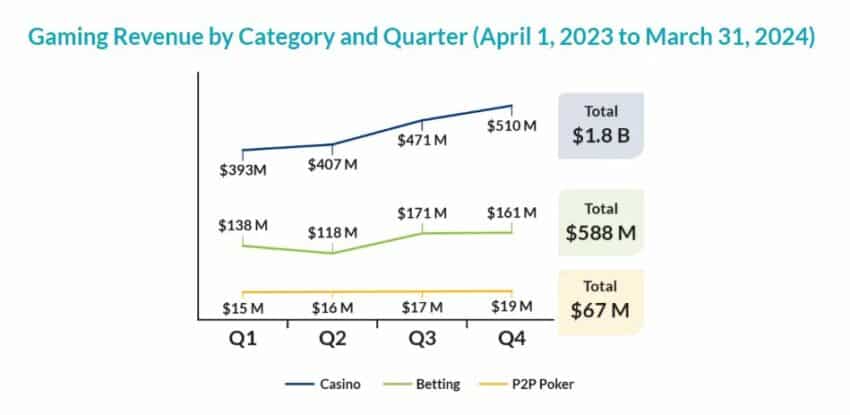

- Q4 iCasino wagers were $14.6 billion, with the 2023-24 year ending at $51.7 billion, an 88% increase over 2022-23 with casino gaming revenue was $510 million, with the 2023-24 year ending at $1.8 billion, an 89% increase over 2022-23.

- Q4 betting wagers were $2.7 billion, with the 2023-24 year ending at $9.7 billion, a 39% increase over 2022-23. Betting includes on sports, esports, proposition and novelty bets, as well as exchange betting.

- Q4 betting gaming revenue was $161 million, with the 2023-24 year ending at $588 million, a 36% increase over 2022-23.

- Q4 peer-to-peer (P2P) poker wagers were $446 million, with the 2023-24 year ending at $1.6 billion, a 64% increase over 2022-23.

- Q4 peer-to-peer poker gaming revenue was $19 million, with the 2023-24 year ending at $67 million, a 67% increase over 2022-23.

More about the market

Ontario provincial regulators have imposed a roughly 20% annual tax rate on private igaming operators, who also have to pay a $100,000 annual licensing fee to the Ontario government to run a commercial gaming site.

Since its inception on April 4, 2022, Ontario’s igaming market has generated roughly $98.74 billion in total wagers and $3.845 billion in total gaming revenue while showing growth each quarter.

| Quarter | Total Wagers | Total Gaming Revenue | Operators | Active Player Accounts |

|---|---|---|---|---|

| Q1 2022/23 | $4.07B | $162M | 18 | 492K |

| Q2 2022/23 | $6.04B | $267M | 24 | 628K |

| Q3 2022/23 | $11.53B | $457M | 36 | 910K |

| Q4 2022/23 | $13.9B | $526M | 44 | 1.1M |

| Q1 2023/24 | $14B | $545M | 46 | 920K |

| Q2 2023/24 | $14.2B | $540M | 47 | 943K |

| Q3 2023/24 | $17.2B | $658M | 49 | 1.2M |

| Q4 2023/24 | $17.8 | $690M | 47 | 1.3M |

| Total since launch: | $98.74B | $3.845B |

It’ll be interesting to see where the market goes from here as it enters its third year of operation. The number of operators in the market has plateaued and the revenue numbers appear to have slowed when compared to Q3 of the last fiscal year. Consolidation in the marketplace is likely inevitable moving forward as operators shift from customer acquisition to customer retention tactics. From a sports betting perspective, two marquee events this summer — Euro 2024 (soccer) and the Summer Olympic Games — should help boost revenue during this typically slow period on the sports calendar.